Turkey's Central Bank Defies Erdogan, Hikes Rates

VOA

14 Sep 2018, 01:35 GMT+10

ISTANBUL - The Turkish central bank caught international markets by surprise Thursday as it aggressively hiked interest rates in an effort to strengthen consumer confidence, stem inflation and rein in the currency crisis.

Interest rates were increased to 24 percent from 17.75 percent, which is more than double the median of investor predictions of a 3 percent hike. The Turkish lira surged above 5 percent in response, although the gains subsequently were pared back.

International investors broadly welcomed the move. 'TCMB [Turkish Republic Central Bank] did show resolve in hiking the one-week repo rate substantially and going back to orthodoxy,' chief economist Inan Demir of Nomura International said.

The central bank had drawn sharp criticism for failing to substantially raise interest rates to rein in double-digit inflation and an ailing currency. The lira had fallen by more than 40 percent this year.

The rate hike is an apparent rebuke to Turkish President Recep Tayyip Erdogan, who has been opposed to such a move.

Only hours before the central bank decision, Erdogan again voiced his opposition to increasing interest rates. The Turkish president reiterated his stance of challenging orthodox economic thinking, arguing that inflation is caused by high rates, although that runs contrary to conventional economic theory. Erdogan also issued a presidential decree banning all businesses and leasing and rental agreements from using foreign currency denominations.

Turkish President Recep Tayyip Erdogan makes a speech during a meeting in Ankara, Turkey, Sept. 13, 2018.

The central bank indicated further rate hikes could be in the offing. 'Tight stance monetary policy will be maintained decisively until inflation outlook displays a significant improvement,' the central bank statement reads.

The strong commitment to challenge inflation was welcomed by investors. 'Most importantly, the CBT seemed to be vocal about price stability risks,' wrote chief economist Muhammet Mercan of Ing bank.

'Crazy' spending

Fueled by August's sharp fall in the lira, which drove up import costs, inflation is on a rapid upward trajectory. Some predictions warn inflation could approach 30 percent in the coming months.

While international markets are broadly welcoming the central bank's interest rate hike, economist Demir warns more action is needed.

'This rate hike does not undo the damage inflicted on corporate balance sheet, and market concerns about geopolitics will remain in place. So this is not the hike to end all problems,' said Demir.

The World Bank and IMF repeatedly have called on Ankara to rein in spending, which they say is fueling inflation. Perhaps in response, Erdogan has announced a freeze on new state construction projects.

In the past few years, he has embarked on an unprecedented construction boom, including building one of the world's largest airports and a multibillion-dollar canal project in Istanbul, which the president himself described as 'crazy.'

Trade tariffs

Investors also remain concerned about ongoing diplomatic tensions between Ankara and Washington. The two NATO allies remain at loggerheads over the detention on terrorism charges of American pastor Andrew Brunson.

People stand outside an exchange office in Istiklal Avenue, the main shopping road in Istanbul, Sept. 13, 2018.

Brunson's detention saw U.S. President Donald Trump impose trade tariffs on Turkey, which triggered August's collapse in the lira. Trump has warned of further sanctions.

'If we somehow sort out our problems with the United States and adopt an orthodox austerity program, we may find a way out of this mess,' said political analyst Atilla Yesilada of Global Source Partners. 'Turkey is a country that has a net foreign debt of over $400 billion, and where 40 percent of [Turkish] deposits are in foreign currency, so the game could be over in a day.'

Turkey has a long tradition of carrying out business in foreign currencies to mitigate the threat of inflation and a falling lira. The growing danger of the so-called 'dollarization' of the economy and the public abandonment of the lira are significant risks to the currency.

Turkish companies are paying the cost for the depreciation of the lira. Analysts estimate about $100 billion in foreign currency loans have to be repaid by the private sector in the coming year. Companies and individuals borrowing in local currency, however, will be facing higher repayments. And most analysts predict the Turkish economy is heading into a recession.

Economist Demir says, though, that the situation could have been far worse.

'In the absence of an [interest rate] hike, the rollover pressures on banks would get even worse, damage on corporate balance sheets would intensify, and local deposit holders' confidence would have weakened further. So this hike, although it doesn't eliminate other risks, eliminates some of the worst outcomes for the Turkish economy,' he said.

Thursday's rate hike appears to have bought time for the Turkish economy and the nation's besieged currency. Analysts say investors are watching to see if Turkey's decision-makers use that time wisely.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Sports Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Sports Sun.

More InformationUS Sports

SectionAstros fill in missing pieces in series against Rangers

(Photo credit: Thomas Shea-Imagn Images) It was fitting that the Astros had to dig deep into their reconfigured bench in the latter...

Guardians carry momentum into series finale vs. White Sox

(Photo credit: Patrick Gorski-Imagn Images) After hitting their season's low point a week ago, the Cleveland Guardians have reversed...

Reds look to beat Rockies, get Terry Francona 2,000th win

(Photo credit: David Richard-Imagn Images) In a span of 10 pitches Saturday, the Cincinnati Reds ensured they wouldn't be swept for...

Red Sox look to enter break on 10-game win streak

(Photo credit: David Butler II-Imagn Images) The Boston Red Sox will be looking to extend their winning streak to 10 games Sunday...

MLB roundup: Garrett Crochet tosses first shutout in Red Sox win

(Photo credit: Eric Canha-Imagn Images) In his 51st career start, Garrett Crochet accomplished two feats in one dominant outing:...

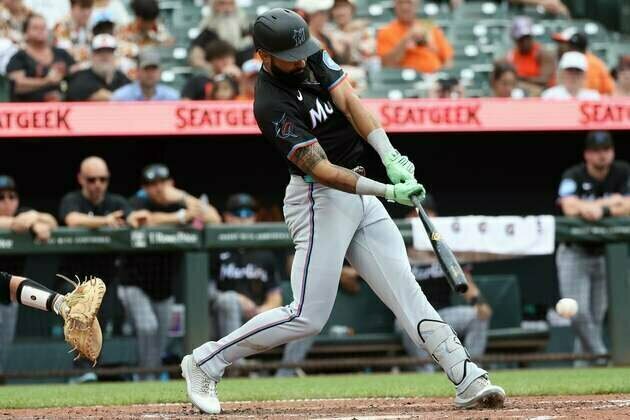

Orioles, Marlins square off in rubber match before All-Star break

(Photo credit: Daniel Kucin Jr.-Imagn Images) Two teams that have long climbs if they're going to reach the postseason needed a sweep...

NFL

SectionDerrick Lewis scores quick TKO of Tallison Teixeira in Nashville

(Photo credit: Steve Roberts-Imagn Images) Heavyweight Derrick Lewis needed only 35 seconds to end the undefeated run of Tallison...

Chargers rookie WR Tre Harris holding out from training camp

(Photo credit: Kirby Lee-Imagn Images) Los Angeles Chargers rookie wide receiver Tre Harris is officially holding out from training...

Five-star TE recruit Kaiden Prothro stays in-state with Georgia

(Photo credit: Joshua L. Jones / USA TODAY NETWORK via Imagn Images) Georgia and head football coach Kirby Smart added to a vaunted...

Cardinals LT Luis Sharpe, 3-time Pro Bowler, dies at 65

(Photo credit: Mark J. Rebilas-Imagn Images) Longtime Cardinals left tackle Luis Sharpe, a three-time Pro Bowl selection, has died...

Ndamukong Suh announces retirement from NFL

(Photo credit: Kirby Lee-Imagn Images) Ndamukong Suh announced his retirement from the NFL on Saturday, issuing a heartfelt statement...

Reports: Bears extend GM Ryan Poles through 2029

(Photo credit: David Banks-Imagn Images) Chicago Bears general manager Ryan Poles has come to terms on a three-year contract extension...