RBI, UAE Central Bank sign MoU to facilitate cross-border CBDC transactions

ANI

18 Mar 2023, 11:25 GMT+10

New Delhi [India], March 18 (ANI): The Reserve Bank of India (RBI) and the Central Bank of the United Arab Emirates (CBUAE) have signed an MoU for innovation in financial products in Abu Dhabi, to enhance cooperation and jointly enable innovation in financial products and services.

Under the MoU, the two central banks will collaborate on various emerging areas of fintech, especially central bank digital currencies (CBDCs) and explore interoperability between the CBDCs of CBUAE and RBI. CBUAE and RBI will jointly conduct proof-of-concept (PoC) and pilot(s) of bilateral CBDC bridge to facilitate cross-border CBDC transactions of remittances and trade, according to an RBI statement.

The RBI on Wednesday said this bilateral engagement of testing the cross-border use case of CBDCs was expected to reduce costs, increase the efficiency of cross-border transactions and further the economic ties between India and UAE. The memorandum of understanding (MoU) also provides for technical collaboration and knowledge sharing on matters related to fintech and financial products and services.

Last month, Reserve Bank of India Deputy Governor T Sankar Rabi said eight banks participated in the central bank digital currencies project, which was launched by the central bank on February 8.

The deputy governor said the pilot project currently covers the five cities of Mumbai, New Delhi, Bengaluru, Bhubaneswar and Chandigarh. The RBI launched the first pilot of the digital rupee on December 1, 2022.

Under the Indian Presidency's theme of "One Earth, One Family, One Future", the Finance Ministers and Central Bank Governors of G20 countries, which met on February 24-25 in Bengaluru, committed to enhancing international policy cooperation and steering the global economy towards securing strong, sustainable, balanced and inclusive growth.

According to a statement -- G20 Chair's Summary and Outcome Document -- released by G20 members on February 25, the members said they would continue to explore the macro-financial implications of the potential introduction and widespread adoption of central bank digital currencies (CBDCs), and their effects on cross-border payments, as well as on the international monetary and financial system. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Sports Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Sports Sun.

More InformationUS Sports

SectionOrioles look to continue taking steps toward .500 vs. Marlins

(Photo credit: Jerome Miron-Imagn Images) The Baltimore Orioles are on a roll. Now it's a matter of keeping it up. They go into...

Twins seek series victory vs. slumping Pirates

(Photo credit: Charles LeClaire-Imagn Images) The Minnesota Twins will try to make it three series victories in a row when they take...

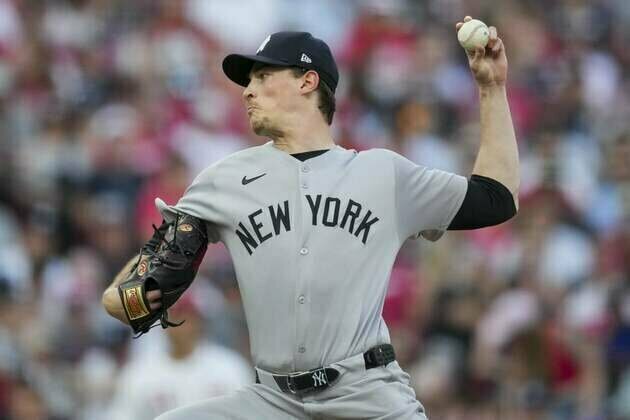

Yankees aim for season-best winning streak against Cubs

(Photo credit: Aaron Doster-Imagn Images) Cody Bellinger spent the past two years rejuvenating his career with the Chicago Cubs....

Cardinals giving Erick Fedde another start against Braves

(Photo credit: Tim Vizer-Imagn Images) The St. Louis Cardinals are giving struggling starting pitcher Erick Fedde at least one more...

MLB roundup: Yanks bomb Cubs on Cody Bellinger's 3 HRs

(Photo credit: Wendell Cruz-Imagn Images) Cody Bellinger hit three homers for the first time in his career and drove in six runs,...

Willy Adames, Giants hand Dodgers 7th straight setback

(Photo credit: Neville E. Guard-Imagn Images) Willy Adames drove in three runs with a triple and a home run, Dominic Smith added...

NFL

SectionReports: Bears extend GM Ryan Poles through 2029

(Photo credit: David Banks-Imagn Images) Chicago Bears general manager Ryan Poles has come to terms on a three-year contract extension...

Facing suspension, Jake Retzlaff withdraws from BYU

(Photo credit: Mark J. Rebilas-Imagn Images) Embattled quarterback Jake Retzlaff announced Friday that he is withdrawing from BYU,...

Chiefs QB Patrick Mahomes against 18-game regular season

(Photo credit: Kirby Lee-Imagn Images) Take it from Chiefs quarterback Patrick Mahomes, a playoff regular since entering the NFL,...

Chargers RB Najee Harris (eye) hurt in fireworks incident

(Photo credit: Kirby Lee-Imagn Images) Los Angeles Chargers running back Najee Harris sustained an eye injury in a Fourth of July...

Trevor Harris, Roughriders put 4-0 record on line vs. Stampeders

(Photo credit: John E. Sokolowski-Imagn Images) Veteran quarterback Trevor Harris returns to action and the Saskatchewan Roughriders...

Report: USC OL DJ Wingfield hires attorney in NCAA eligibility battle

(Photo credit: Alex Martin/Journal and Courier / USA TODAY NETWORK via Imagn Images) Southern California offensive lineman DJ Wingfield...