What is systemic risk and how does it lead to a banking crisis?

The Conversation

22 Mar 2023, 17:09 GMT+10

The recent collapse of Silicon Valley Bank (SVB), a regional US bank that funded start-up companies in the technology and innovation sector, has created a worldwide wave of financial instability.

Despite the efforts of US financial regulators to contain the potential damage by immediately providing full protection to the bank's depositors, the collapse triggered a global dip in banking share prices.

The turmoil in financial markets led to the collapse of Swiss banking giant Credit Suisse, which was promptly taken over by UBS, an even larger bank. This was after an initial US$54 billion (Pound 45 billion) lifeline from the Swiss central bank proved to be insufficient to rescue Credit Suisse.

How is it possible that the collapse of a relatively small financial institution like SVB could be so contagious as to end up having global consequences, including bringing down a 167-year-old financial institution like Credit Suisse?

Answering this question requires an understanding of systemic risk, which refers to risks associated with the entire financial system. Broadly speaking, there are two distinct sources of systemic risk: balance sheet contagion and information runs.

Balance sheet contagion

The risk of balance sheet contagion arises from the vast number of financial agreements between companies in the international financial system. No bank operates in isolation - they are all tightly interconnected through agreements that might include both short-term and long-term loans, and various other contract types such as derivatives.

The largest financial institutions are also typically the most interconnected, providing and receiving credit from many others. When one or more of these large institutions suffer losses that cannot be covered by their capital (the value of their assets), they become insolvent. This means they are unable to fully meet their obligations, for example if they owe money to another bank. These other banks will then also suffer losses which can spread even further, affecting their creditors and creating a potential cascade of failures.

The huge intervention in financial markets by US and European financial authorities following the collapse of Lehman Brothers in 2008 aimed to avoid such contagion. In fact, the 2008 global financial crisis is a good example of the systemic risk that these large organisations with so many interconnections pose. They become "too big to fail" because their collapse will affect not only the financial system, but the whole global economy.

Information runs

On the other hand, the recent banking crisis is an example of a systemic risk event caused by an information run. This is triggered when problems in one part of the system raise concerns about the financial robustness of other parts.

For example, an announcement about SVB's asset losses on March 8 2023 caused its customers with unprotected deposits to rush to the bank to withdraw their money. The eventual closure of SVB raised concerns that other banks might be suffering from similar losses. This encouraged investors around the world to sell banking shares, causing a rout in the industry's stock.

Information runs happen when investors and depositors don't have the full picture about the banks whose shares they hold or in which they have deposited their money. This causes them to draw inferences about the financial health of these banks by observing what happens in the rest of the system. People make the reasonable assumption that banks around the globe are making similar investment decisions to the one that has just collapsed.

Understanding systemic risk and its implications for global markets has been an important research topic for financial economists for a long time. Last year, Douglas Diamond and Philip Dybvig were awarded the Nobel Prize in Economics for their research in this area. In 1983, they introduced a theoretical model that explains the mechanism by which rumours about banks can lead to their eventual collapse.

Unfortunately, 40 years later, the international banking system has just provided another striking example of the very instability that Diamond and Dybvig outlined in their work.

Unintended consequences

The complex interplay between the global economy and the international financial system implies that policies aiming to solve one problem can have unintended consequences - with potentially large systemic effects.

Recent inflationary pressure due to rising energy prices and the war in Ukraine has led central banks to raise interest rates to curb global demand and try to reduce inflation. However, rising interest rates caused a drop in the prices of fixed-income securities such as government bonds. These bonds are held by financial institutions like SVB that then see the value of a significant portion of their assets drop. This limits their ability to raise funds and satisfy the demands for liquidity from other banks, businesses and households.

Such issues can quickly spread throughout the financial system and, if they infect a large bank, the impact can multiply very quickly - as we have seen during the 2008 financial crisis and more recently.

The danger to the entire financial system from a few giant banks failing is well recognised. The irony is that, during both the global financial crisis and the recent financial turmoil, part of the solution has been for failed institutions to be absorbed by even bigger banks. Such consolidation enhances systemic risk by potentially sowing the seeds of future crises.

Author: Spiros Bougheas - Professor of Economics, University of Nottingham

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Sports Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Sports Sun.

More InformationUS Sports

SectionHot-hitting Red Sox hope to continue feasting on Rockies

(Photo credit: Paul Rutherford-Imagn Images) The Boston Red Sox are facing a light portion of their schedule and taking advantage...

Nolan Schanuel's bases-loaded walk in 9th lifts Angels past Rangers

(Photo credit: Gary A. Vasquez-Imagn Images) Nolan Schanuel drove in the winning run with a bases-loaded walk with one out in the...

Diamondbacks defeat Padres as Manny Machado gets hit No. 2,000

(Photo credit: Denis Poroy-Imagn Images) Josh Naylor homered, Zac Gallen pitched six strong innings and the visiting Arizona Diamondbacks...

Giants score twice in 8th to get by Phillies

(Photo credit: Ed Szczepanski-Imagn Images) Matt Chapman had three hits and scored twice and the San Francisco Giants, scoring all...

White Sox hope to put an end to Blue Jays' winning streak

(Photo credit: Kamil Krzaczynski-Imagn Images) A common refrain during the Toronto Blue Jays' best winning streak in a decade has...

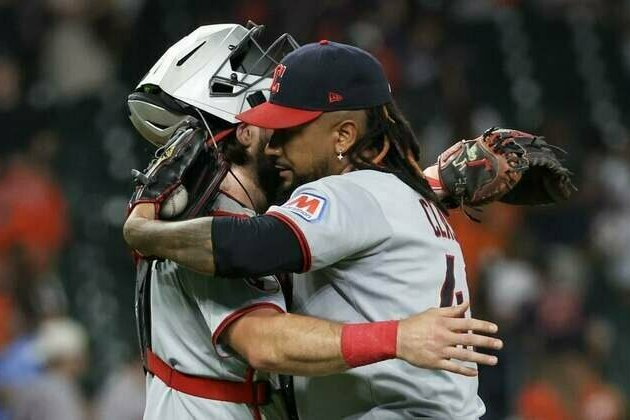

MLB roundup: Guardians top Astros to halt 10-game skid

(Photo credit: Thomas Shea-Imagn Images) Brayan Rocchio lined a go-ahead, two-run double into the left field corner with two outs...

NFL

SectionState of Kansas extends deadline for Chiefs, Royals stadium funding

(Photo credit: Denny Medley-Imagn Images) Kansas remains in the running to provide the future home of the Kansas City Chiefs and...

Houston Astros donate $1M to help recovery from Texas floods

(Photo credit: Rick Jervis / USA TODAY / USA TODAY NETWORK via Imagn Images) The Houston Astros are donating $1 million to support...

Report: ESPN signing NFL analyst Dan Orlovsky to long-term extension

(Photo credit: REUTERS/Mike Segar) Dan Orlovsky, who has served as an NFL analyst with ESPN since 2018, has agreed to terms on a...

Trump calls Texas floods a '100-year catastrophe', says Gaza deal likely this week

(New Jersey) [US], July 7 (ANI): US President Donald Trump on Sunday (local time) described the floods in Texas as a '100-year catastrophe'...

Cowboys All-Pro KR KaVontae Turpin arrested on 2 charges

(Photo credit: Andrew Dieb-Imagn Images) Dallas Cowboys All-Pro kick returner KaVontae Turpin is facing misdemeanor charges of possession...

Cowboys make $500K donation to assist with Texas flooding

(Photo credit: Paul Witwer/Standard-Times / USA TODAY NETWORK via Imagn Images) The Dallas Cowboys are donating $500,000 to the Salvation...